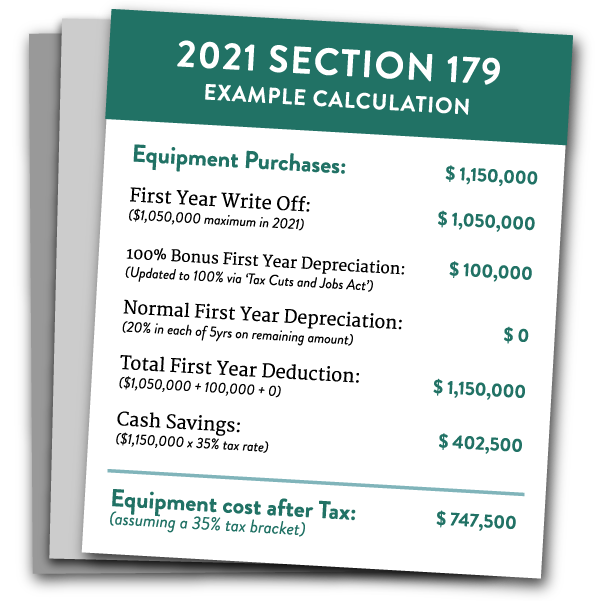

2021 Section 179 New/Used Equipment Tax Deduction

Section 179 allows businesses to take an immediate deduction for business expenses related to depreciable assets such as new and used processing equipment. With a maximum deduction of $1,050,000, businesses can lower their current-year tax liability rather than capitalizing an asset and depreciating it over time in future tax years. Contact your tax preparer today to see if this opportunity could assist in your next equipment purchase.